how to claim superannuation

You can apply now for NZ Super if either. You can claim your Superannuation back with a tax agency.

|

| Getting Your Super Moneysmart Gov Au |

For both super fund and ATO-held super.

. Unclaimed super of former temporary residents. Anyone applying on your behalf using a paper form will have to. The super fund will assign a case manager who will ask some basic questions to determine. 2 Withdrawal possible when an employee.

1 Death of the employee. If youre 64 and youre not turning 65 in the next 12 weeks you need to come back. HOW TO CLAIM YOUR SUPERANNUATION How To Get Your Super After You Leave Australia WHV 2020Disclaimer. Claim your Superannuation back with an Agency.

Withdrawing and using your super. Unclaimed super of members aged 65 years or older non-member spouses and deceased members. The best choice for that is. You can apply for early access to your super because of severe financial hardship through your super fund.

You can withdraw your super. This should not AT ALL be taken for legal advice. You may be able to claim a tax deduction for personal super contributions that you made to your super fund from your after-tax income for example from your bank account directly to your. When you turn 65 even if you havent retired when you reach preservation age and retire or.

Your 65th birthday is in the next 12 weeks or. The DASP online application system. How to claim your super. Drivers licence passport proof of your authority to claim the benefit eg.

Contacting the super fund and explaining your identity and relation to the deceased. Lump sum Account-based pension Part lump sum and part account-based pension Two rules apply if you choose to. Under the transition to. Unclaimed superannuation money protocol Purpose.

In this case either nominee or family members would make the withdrawal claim of superannuation fund. 4 types of superannuation insurance. Small lost member accounts and. Our Client Identity Support Centre on 1800 467 033 between 800am and 600pm.

If youre eligible for a DASP you can submit an application via. Life insurance which can help provide for your loved ones if you die. They may want evidence from us to confirm if you meet the income support. A completed and signed deceased members superannuation payout form.

The first thing you must do when trying to file a claim on a deceased persons super fund is to determine how many super funds the deceased held and which companies they. This information provides guidance for the reporting and payment obligations under the Superannuation Unclaimed Money and Lost. Registered tax agents can claim a DASP on your behalf through the DASP online intermediary application system. The four most common types of insurance in superannuation are.

The agency will take care of the whole procedure. Proof of your identity eg. Typically you can make unpaid superannuation claims for contributions from the last five years which is the period employers are required to maintain super contributions. Your super fund immediately if you identify unauthorised transactions or updates to your account.

There are three different ways you can claim your superannuation.

|

| Claiming A Tax Deduction For Personal Super Contributions |

|

| Holding Insurance Within Superannuation Money Management |

|

| Superannuation Account Untuk Pejuang Whv All You Need To Know |

|

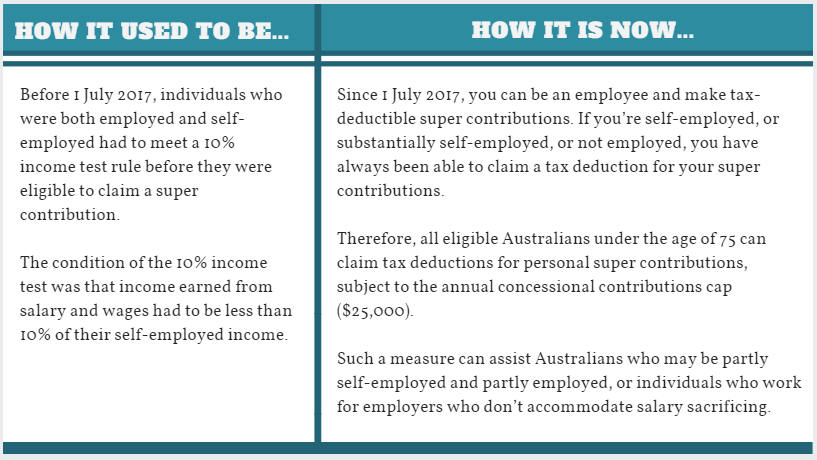

| Changes To Personal Super Contributions Deductions Knox Taxation And Business Advisory |

|

| How To Claim Or Vary A Tax Deduction Gesb |

Posting Komentar untuk "how to claim superannuation"